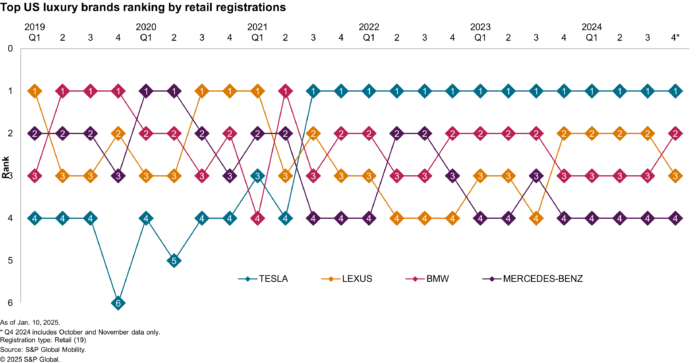

Lexus, a leader among non-Tesla brands in the US luxury car

market, has experienced a series of successful quarters.

According to S&P Global Mobility's registration data, Lexus

has topped all non-Tesla luxury brands in retail registrations for

each of the past four quarters for which we have complete

registration data (Q4 2023 – Q3 2024). This is the first time in

six years Lexus has enjoyed such a prolonged period of success.

Also, prior to this achievement, Lexus had not reached the No. 2

rank in the luxury space since the third quarter of 2021.

SUVs a key driver of Lexus' success in the luxury car

market

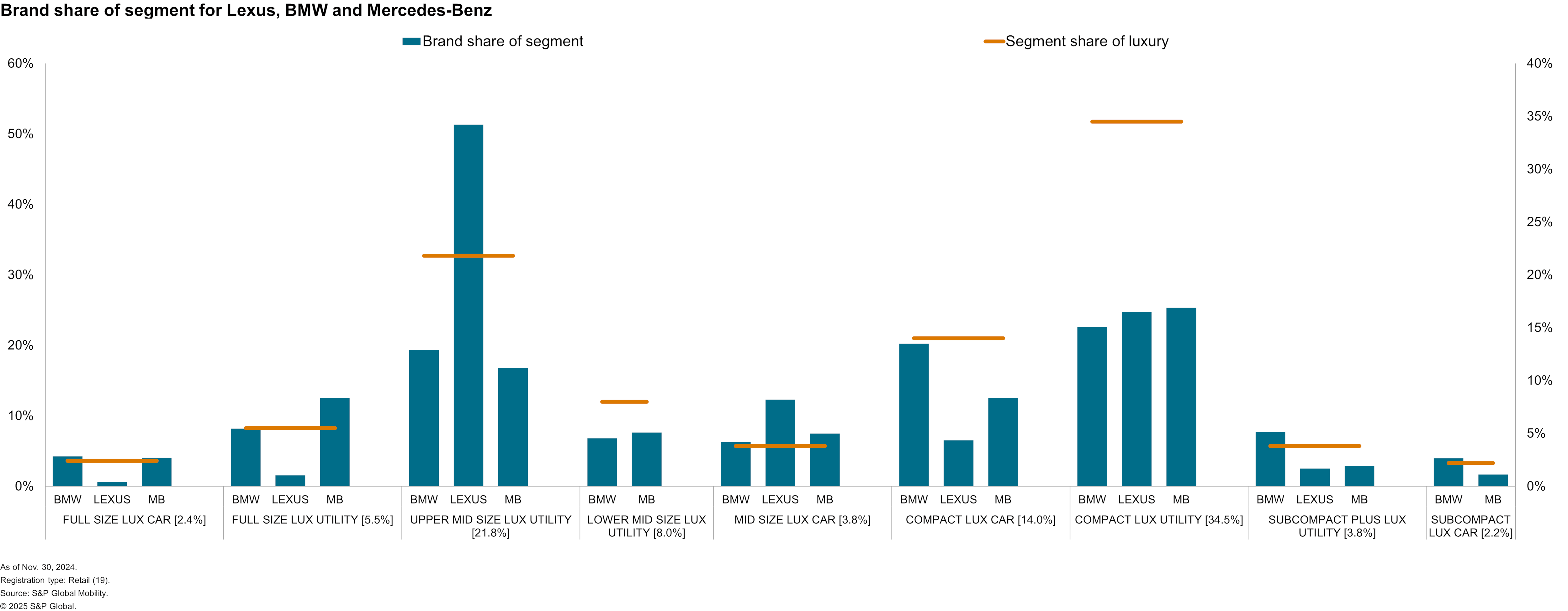

There are at least two reasons for Lexus' recent success.

First, Lexus is vastly outperforming its rivals in the second

largest part of the luxury market, the upper midsize luxury utility

segment. This segment overall accounted for 22% of retail luxury

registrations in the first 11 months of 2024.

Lexus accounts for over half of new vehicles registered in this

category, thanks to the ongoing appeal of the RX, the brand's

standard-bearer since its arrival in 1990. In the 10-plus year

period from January 2014 through November 2024, the RX is not only

the most popular non-Tesla utility, its total retail volume of

1,062,632 for that time period is almost double that of the next

utility, the Acura MDX, at 550,805.

Lexus' 51% share of the upper midsize luxury utility segment is

more than double BMW's share of 19.4% and Mercedes-Benz's share of

16.8%.

Lexus hybrid vehicles also surpass rivals

Second, Lexus is outperforming its chief rivals—BMW and

Mercedes-Benz—in the growing hybrid market in the midsize

luxury utility segment, where Lexus already does well.

Nationally, hybrids comprised 13% of all new US retail

registrations in the first 11 months of 2024, an increase from

10.3% the year prior. Meanwhile, electric vehicles accounted for

9.1% of registrations, up from 8.4% a year ago. In November 2024,

the hybrid share jumped to an all-time monthly record high of

15.3%.

Lexus has been able to take advantage of this surge in hybrid

popularity by marketing hybrid versions of its most popular models.

In particular, the RX accounts for more than half of all new retail

registrations in the upper midsize luxury utility segment, and 20%

of these RX registrations are hybrids.

Lexus excels in compact luxury utility

segment

In the compact luxury utility segment, the largest luxury

category, Lexus further manages to hold its own. The brand commands

24.7% of the segment, higher than BMW but trailing

Mercedes-Benz.

While Lexus' entry in this segment, the NX, captured just 8.3%

of new vehicle registrations through November 2024, this is a

greater share than any non-Tesla model. Importantly, 45% of NX

registrations were hybrids.

BMW's entry in the compact luxury utility segment, the X3, is

not available with a hybrid propulsion system. Mercedes-Benz's

small utility, the GLC, is available as a hybrid, but this option

only accounts for 3.2% of retail registrations.

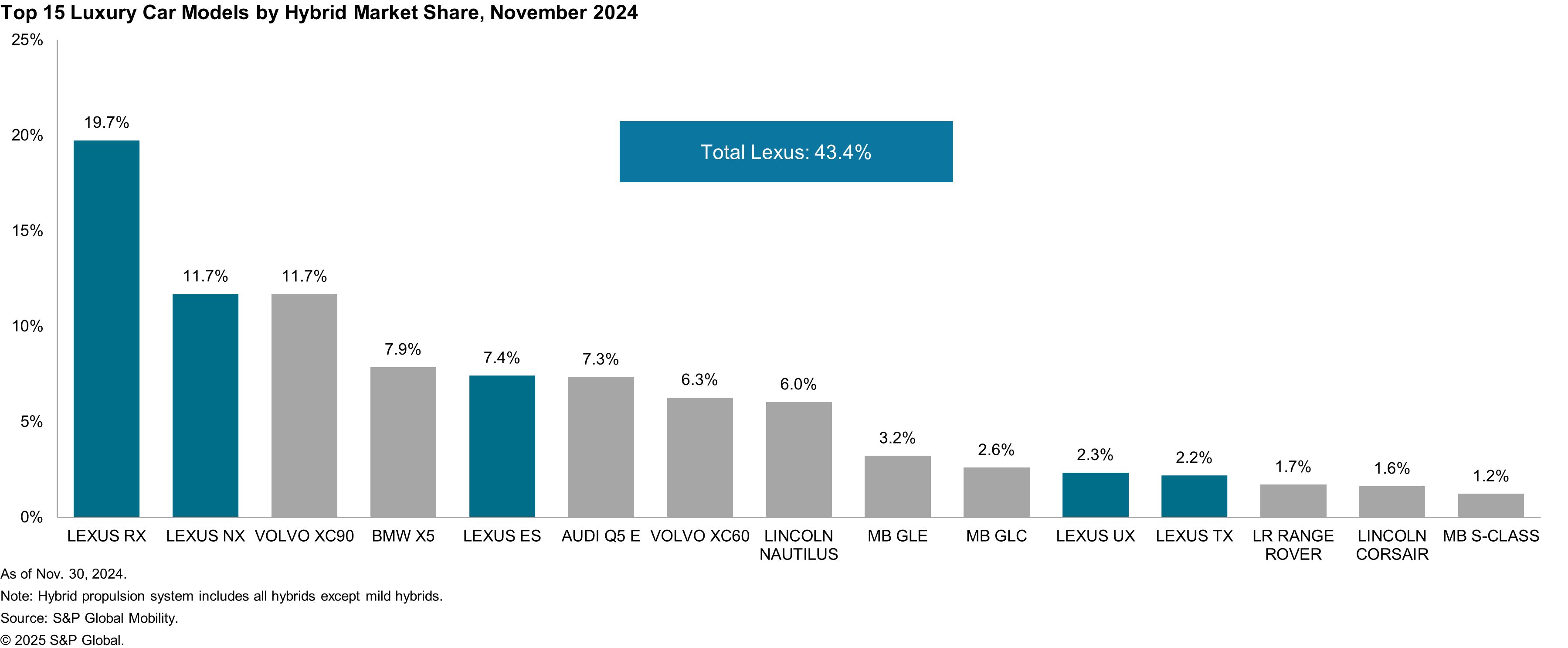

A list of the 15 most popular luxury hybrids through the first

11 months of 2024 illustrates Lexus' strength in hybrids (see

below). Six of these products are the Lexus brand, versus three

Mercedes-Benz products and just one BMW.

The six Lexus models together accounted for more than 4 of every

10 luxury hybrids registered in November 2024 as well, a dominant

and impressive performance given that 35 luxury hybrids had at

least one registration in November.

Lexus is marketing the powerful combination of appealing

products in the largest sectors of the luxury market and the

availability of a hybrid propulsion system for these products. In

doing so, they are offering a product portfolio well-suited to

today's auto landscape and one that has driven the brand to the top

of the non-Tesla field.

Demo Our Loyalty Analytics Tool

Source link